Palm oil prices rebounded modestly after two days of pullback, supported by a 6.8% rise in Malaysian exports during June 1–25, driven largely by increased demand from the EU and Middle East. Market sentiment also benefited from expectations of lower production in the same period, giving futures a slight lift.

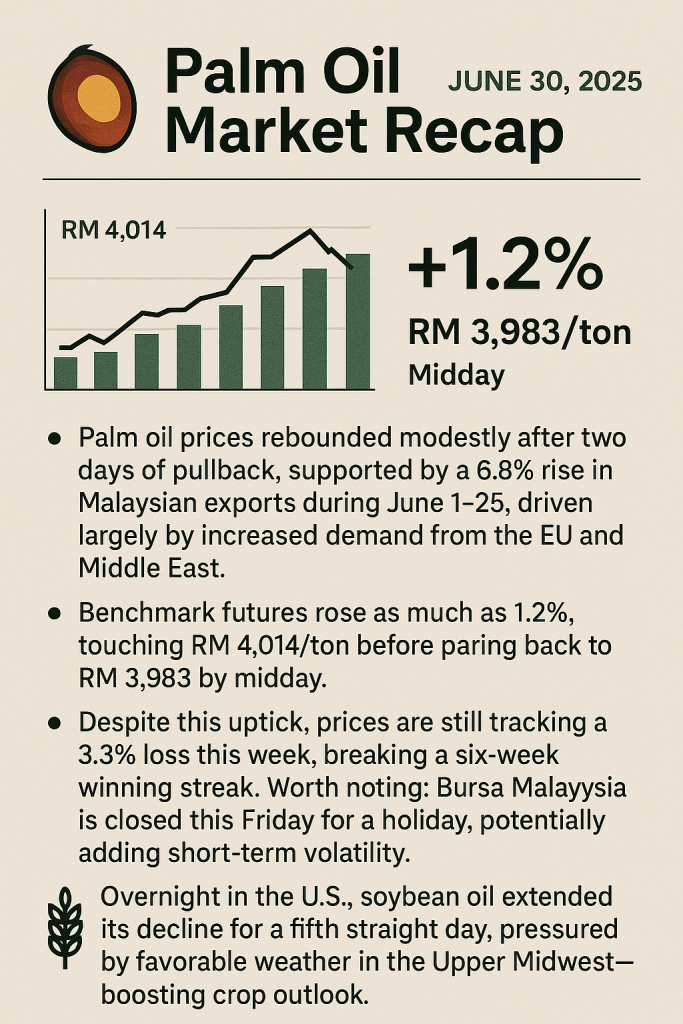

💡 Benchmark futures rose as much as 1.2%, touching RM 4,014/ton before paring back to RM 3,983 by midday. Despite this uptick, prices are still tracking a 3.3% loss this week, breaking a six-week winning streak. Worth noting: Bursa Malaysia is closed this Friday for a holiday, potentially adding short-term volatility.

🌾 Overnight in the U.S., soybean oil extended its decline for a fifth straight day, pressured by favorable weather in the Upper Midwest—boosting crop outlook. This comes after last week’s geopolitical premium from Middle East tensions and U.S. biofuel policy hopes began to unwind.